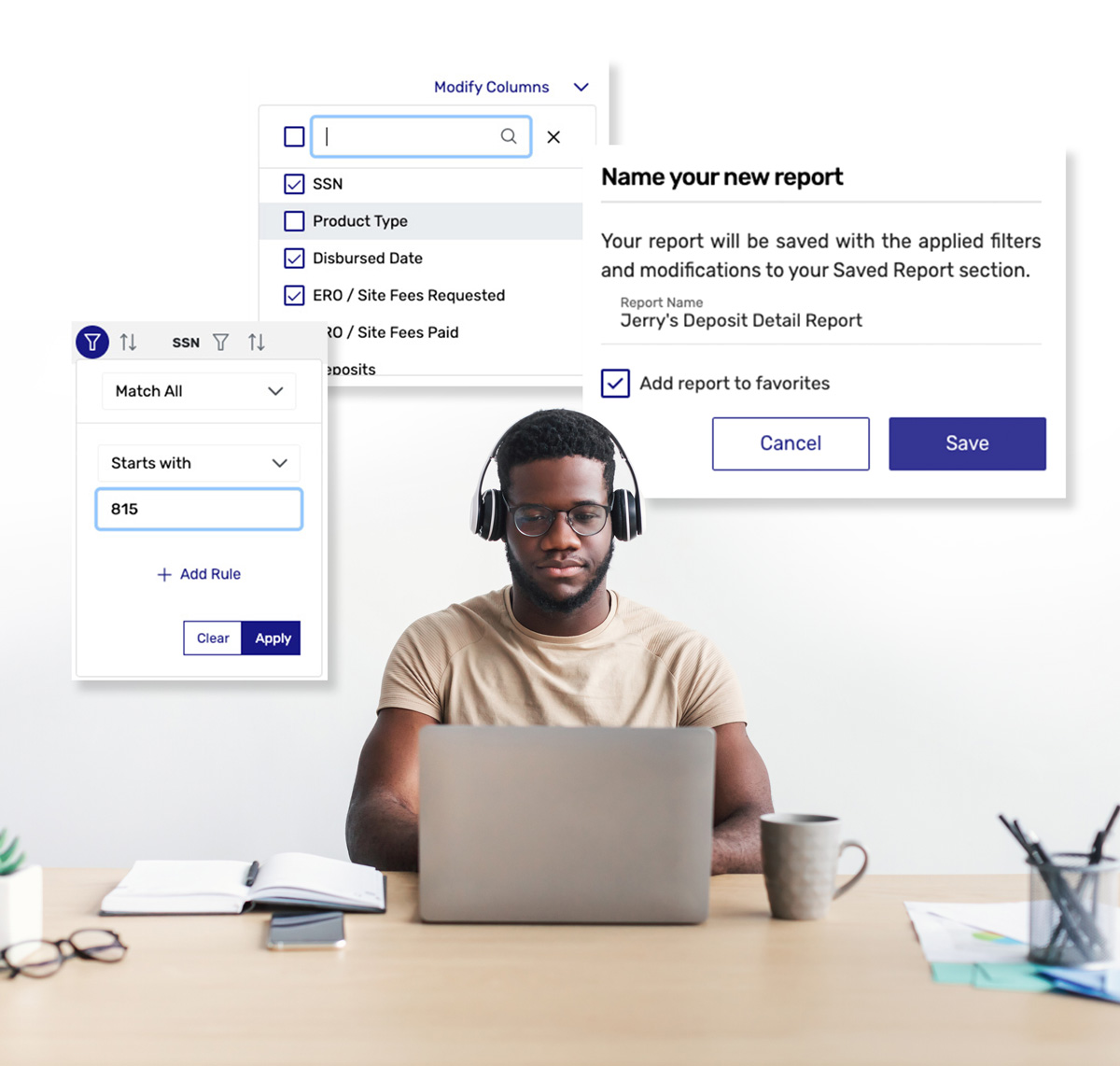

Find what you need in less time

Personalized reports help you manage your money

- Filter, sort, search and more

- Add and remove columns to see what's important

- Customize and save your favorite reports

- Export to csv or pdf

Run reports from anywhere

Run reports from any mobile device

- All reports available for desktop and mobile device

- Filter, sort and search to quickly find what's important

- Optimized for mobile users

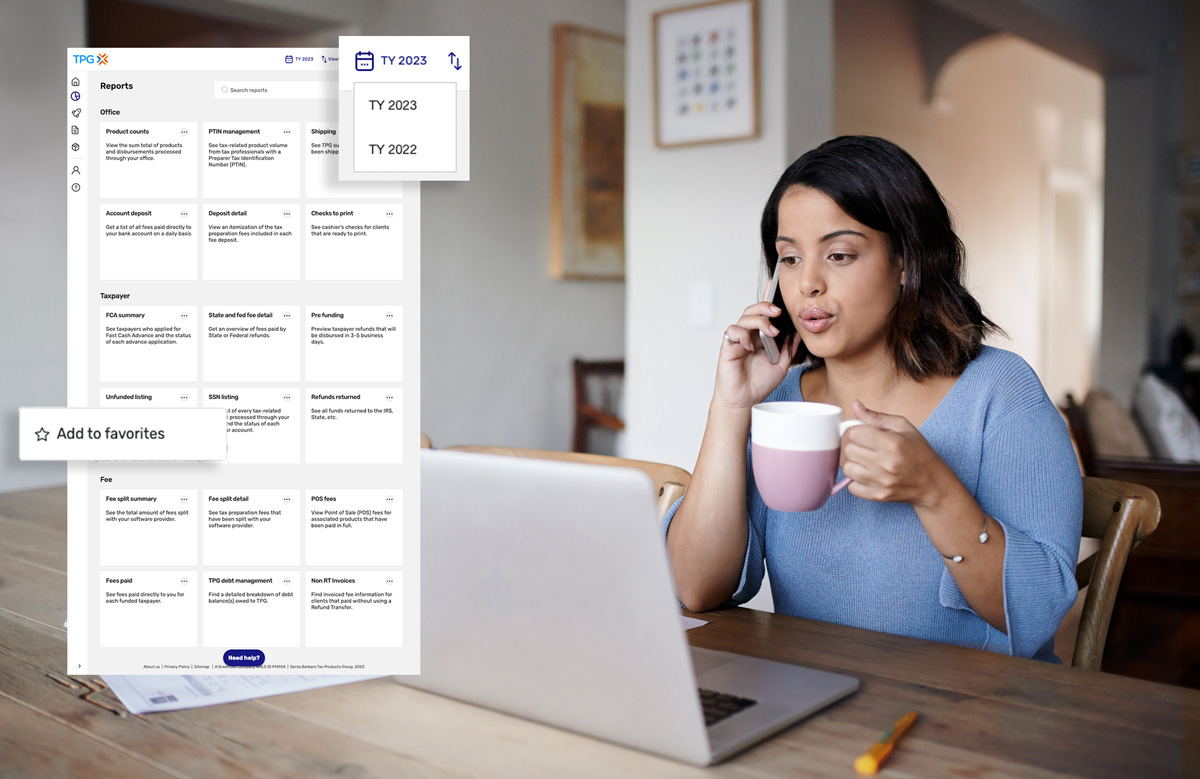

Powerful reporting

Report on dozens of data points to easily find what you need

20+ reports

Additional multi-office reports also available

Choose from over 20 pre-built reports which you can modify and save as your own custom reports.

Multi-office reports

Additional reports also available

Whether you are a service bureau or you own multiple locations, view aggregate reports for all locations or view by a single office.

Multi-year reporting

Run current and prior year reports

Starting in 2022, TPG now offers historical reports so going forward you can track trends and view historic data for your office.

Easy-to-use reporting

A multi-year redesign of the TPG report engine completed in 2023 offers more tools for managing your business.

- Ongoing report enhancements

- Now over 18+ reports available

- Track your payments, client details and more

Drill-in for details

Linked reporting offers more info in a single click

- Client names and SSNs link you to a taxpayer overview for more details

- Get a client summary in a single click

- ERO office summary also available to service bureaus and multi-office EROs

Experience the difference

Did you use TPG in 2022?

Login to our tax pro website with your existing username and password to see the difference.

Please check with your software provider for program and product availability. Refund Transfers are deposit products using Green Dot Bank, Member FDIC that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.