Step on the gas – 5 ways you can grow in 2021

It's hard to believe that any small business can get ahead during the pandemic. If the industry rumors are true, 2021 may be a year of consolidation where established and aggressive tax professionals grow while marginal players make their exit.

Side hustle EROs exiting the industry?

Industry players are seeing some smaller tax professionals that prepare returns as a side hustle or as a very small part of a multi-service exit the tax industry. As millions of businesses and individuals face a COVID-related cash crunch, focus shifts to spending time and resources on primary revenue generating activities. When tax preparation is a small part of their bottom line some are choosing to exit the industry.

Opportunity for tax professionals like you?

If the industry consolidates with fewer tax professional preparing returns for a growing population of taxpayers, this may be your opportunity to increase share in your community. Here are 5 tips for growing your tax preparation client base in 2021.

#1 - Offer expertise when confusion abounds

State and federal tax law changes occur every year, and with the complexity of the pandemic including multiple Economic Impact Payments, PPP loans for business clients, etc. taxpayers need an expert more than ever. The work you invested in the off-season getting up to speed on tax law changes will pay off as you separate yourself from the field of competitors.

Highlight your credentials without making someone enter your office

While most tax professionals hang certificates on their wall to validate their credentials that won't help you reach taxpayers searching online for a local tax expert. Displaying your qualifications online will help you influence a taxpayer during their evaluation process. Don't have a web presence? Use tools like Marketing Pro to quickly establish a web presence.1

This is good

This is better

#2 - Spread the word on social

There isn't a more affordable or easier way to extend your reach than social media. That's not to say it's easy, and social media does require a strategy and an investment of time. Demonstrating expertise with relevant posts and consistent reminders about upcoming deadlines, tax law changes and more will help position you as the local tax expert.

Need content to share? TPG offers dozens of free videos like these in English and Spanish. Visit our Marketing page to view more.

#3 - Be prepared to service all types of clients

It doesn't matter whether you are a pro-mask or anti-mask, pro-vaccine or anti-vaccine, personal preference takes a back seat to client preference. Be prepared to accommodate all types of taxpayers and you'll widen your net to reach more clients.

Since the pandemic started 76% of consumers have changed stores, brands or the way they shop and the majority plan to continue using the new brand even after the pandemic.1 So It's not your opinion that matters, but the opinions of taxpayers that you need to take into consideration as you work to retain clients or attract new clients that aren't satisfied with their current tax professional.

Do you offer a remote solution?

Do you offer a remote tax preparation option to service clients that are not ready to come back to your office? Can they:

- Find information about your tax practice online

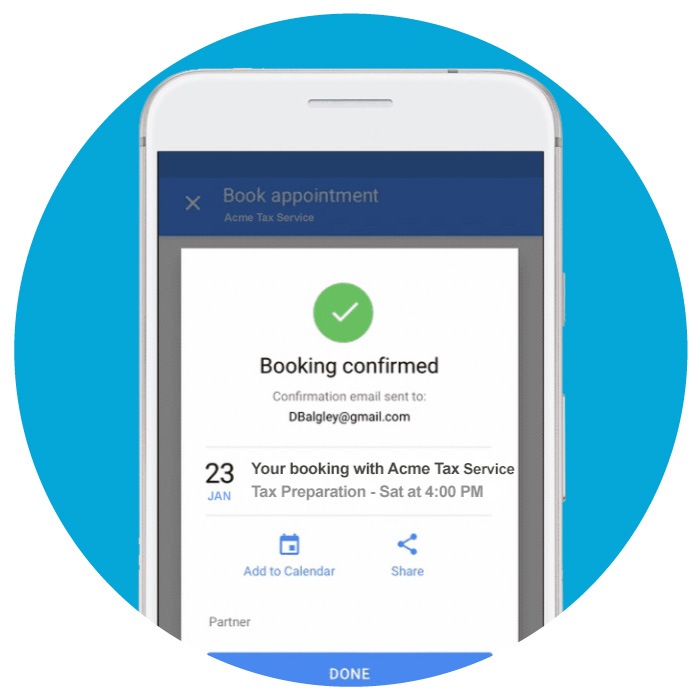

- Book appointments online

- Conduct a virtual appointment via Zoom

- Upload documents securely to you

- Digitally sign documents

Make sure you are prepared with both a digital marketing platform like Marketing Pro, tax preparation software, and other tools that accommodate remote tax preparation.

Are you prepared for higher standards?

Consumers expect a new level of cleanliness. While long time repeat clients may overlook a little clutter, new clients will have higher expectations. While taxpayers want accurate tax preparation, it's necessary to provide a clean environment for both health reasons and client perception.

A clean and tidy office communicates attention to detail. The inverse is also true. Taxpayers view the quality of your tax preparation by the appearance of your office environment.

#4 - Provide solutions that meet unprecedented needs

Taxpayers are facing unprecedented challenges and the need for cash flow has never been greater, with an impact that has hit some communities much harder than others.

1 in 4

Have had trouble paying bills since the pandemic started

4 in 10

Say they or someone in their household lost a job or wages because of COVID

1 in 6

Have borrowed money from friends or family or gotten food from a food bank

Source: Pew Research Center

Offer a pay-by-refund option

Giving clients the option to pay-by-refund makes high quality tax preparation available to anyone expecting a refund without depleting cash or adding credit card debt.4

Your fees are withheld from the tax refund and the net amount is disbursed to clients by direct deposit, cashier's check, Green Dot Prepaid Visa Card or Walmart Direct2Cash.

Help those who can't wait for a refund

The PATH Act prevents the IRS from releasing tax refunds before Feb. 15, but some taxpayers can't wait weeks for their refund.

Offering a tax time advance like Fast Cash Advance helps you build lasting trust with clients with cash flow. And there may be no cost to you when clients receive their refund on a Green Dot Prepaid Visa® Card.4,5

#5 - Build your brand with creative servicing options

While we're fortunate that tax preparation is considered an essential service, some tax professionals may face new office capacity restrictions and adapting to client expectations which have changed. There may be an opportunity for you to stand out. What service can you offer that sets you apart?

Remote pickup

Create a premium customer experience with your staff providing document pickup and delivery.

Drive thru tax prep

Give clients the option to drop off their tax docs and continue the client interview virtually.

Courier Service

Offer a signature-required express mail option for taxpayers that don't want to leave their home.

Online scheduling

Avoiding rush times and feathering out clients across the day has always made sense and makes even more sense now.

Unique locations

Looking to make an impact or add another location? This is a great time to stand out with a new concept.

Virtual appointment

Offer virtual tax preparation and share docs via secure client portal and capture remote signatures.

Even in challenging environments there's an opportunity to grow

Despite unprecedented challenges there are always opportunities to shift your business into high gear and grow. As small competitors exit tax preparation take the opportunity to grow your tax practice and build your brand.

1 Separate fees apply for the Marketing Pro service.

2 Source: McKinsey & Company COVID-19 US Consumer Pulse Survey 11/9-11/13/2020.

3 Refund Transfers are deposit products using Civista Bank, Member FDIC, that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.

4 Card issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. ©2021 Green Dot Corporation.

5 Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., member FDIC (it is not the actual tax refund) and is available at participating locations. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Fees for other optional products or product features may apply, and will be disclosed at the time of application. Tax returns may be filed electronically without applying for this loan. Loans are offered in amounts from $500-$6,000 and are offered both pre–IRS acknowledgment of the tax return and post-IRS acknowledgment of the tax return. All loans have an Annual Percentage Rate (APR) of 39.95%. For example, for a loan of $2,000 with a repayment period of 30 days, the total amount payable in a single payment is $2,065.67 including principal and interest. Loans subject to the Military Lending Act have a lower rate. Not all consumers will qualify for a loan or for the maximum loan amount. Offer and terms subject to change at any time without prior notice.