Refund Transfers | Advances | Fee Collection | Marketing

Give clients more payment options

At tax time and all year long

Give clients a pay-by-refund option

Give your client the option to pay for tax prep with their refund, and there's nothing to pay up front. Once we receive the refund, your fees are withheld and paid by direct deposit.1

Collect payments from past due clients

For the handful of clients that pay-by-refund and don't receive funding, use Auto Collect and collect from past due clients.2 You only pay for fees that are successfully collected.

Give clients more ways to pay for your services

Whether accepting credit or debit payments online or in your office, offer payment options that work for your clients. Collect fees all year long for professional services you offer.3

Need new ideas for growing your tax practice?

Get a free personalized marketing playbook

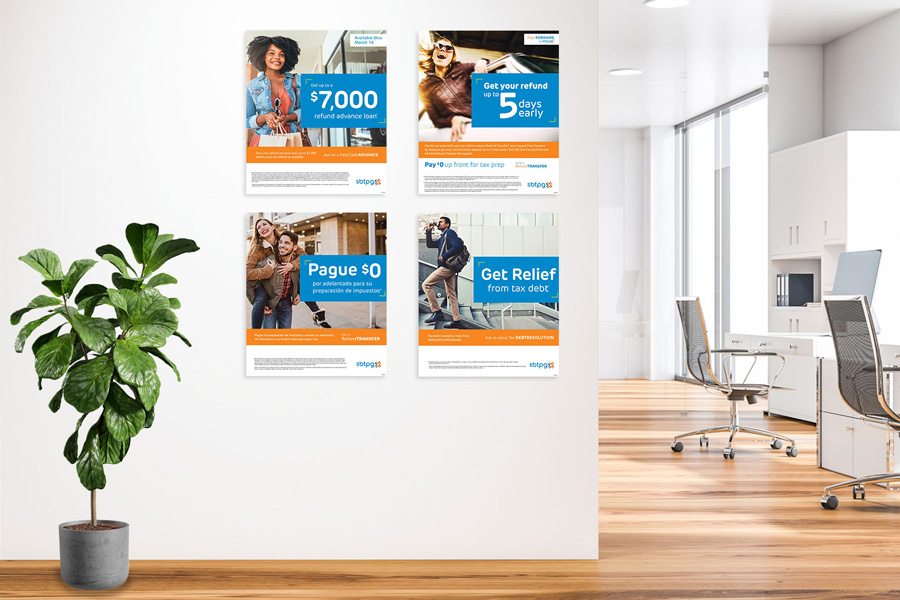

Products to help you compete

Set your office apart at tax time

NEW! Give clients early access to their refund!

Your clients can request Fast Forward by sbtpg when they select the Refund Transfer with direct deposit. When the IRS funds their federal refund, they can get their refund direct deposit up to 5 days early.4 Process 10+ funded Fast Forwards & earn $5 per client.5

Attract more clients with more money

Compete with big chains and attract or retain more clients with a refund advance loan. Up to $7,000 available Jan. 2 thru Mar. 14. Offer cash before they can access their refund.6,7 There's no ERO fee* when clients receive their refund and post-ACK advance loan on a Green Dot® Prepaid Visa® Card.8

A great way to issue Refund Transfers

Clients that pay-by-refund can now request Green Dot and access their refund using a Green Dot® Prepaid Visa® Card. Clients that choose Green Dot are notified when their refund is ready, you can earn a $5 or $39.95 incentive9, and you receive additional free marketing resources for your office.10

* After $39.95 incentive.

Offer tax resolution & IRS representation

Have balance due clients that require tax debt resolution and IRS representation services you don't offer? Don't send clients to a competitor. Partner with tax debt resolution specialists to provide above and beyond protection to your clients without investing time to offer these services internally.11

Expand your services to self-employed clients

Have self-employed clients that may qualify for the Paid Sick and Family Leave Credit? Help these clients claim overlooked tax credits and financial benefits. Diversify your revenue, and expand the services you offer to self-employed clients beyond just accounting and bookkeeping.12

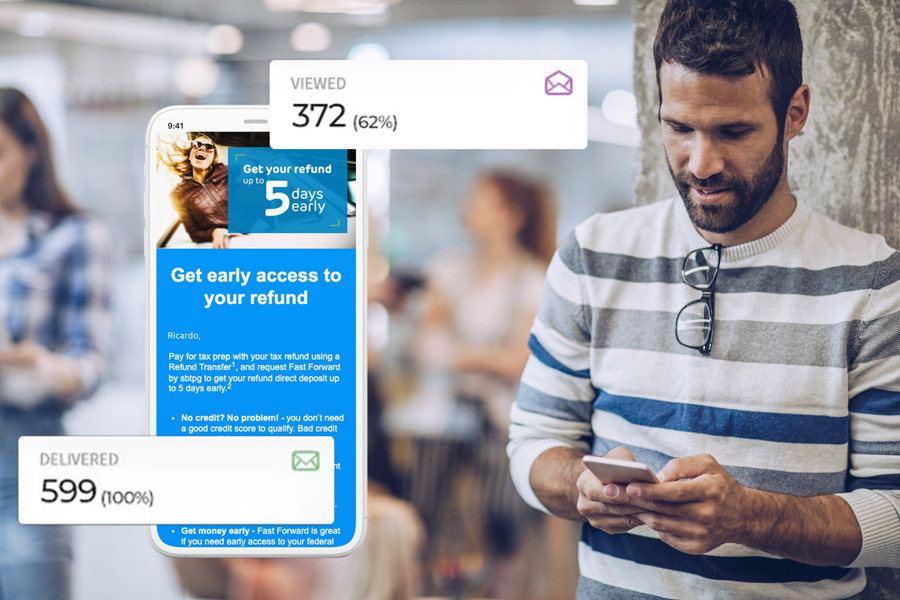

Promote and manage your practice like a pro

Unlock the digital marketing and business management designed for tax professionals with Marketing Pro.

- Online appointment scheduling & auto-reminders

- Multi-page website and secure client portal

- Email marketing with pre-built templates13

Cash flow to fund your growth

Purchase software with a no cost loan

Get a no cost loan and purchase your tax preparation software today. Lock in the best software renewal costs without paying out of pocket.14

Cash flow help available starting in October

Up to $67,800 in cash flow to help with season startup expenses. Now available to new and existing sbtpg clients starting Oct. 7.15

Skip the wait to get paid with a fee advance

Get an advance on your tax preparation fees so you get paid in days, not weeks. Up to $338,800 available to qualified tax pros.16

NEW! Get a credit card powered by your car

We partnered with Yendo to offer the first credit card secured by the value of your car - not your credit score. Up to $10,000 available today to qualified tax pros.17

More resources for tax pros

What you need to grow and manage your tax practice

NEW! Cybersecurity solution for tax pros

Activate our all-in-one cybersecurity solution to get everything you need to remain compliant with IRS Publication 4557 & FTC Safeguards Rule. Protect taxpayer data and your tax practice with tools and training resources designed for tax pros.18

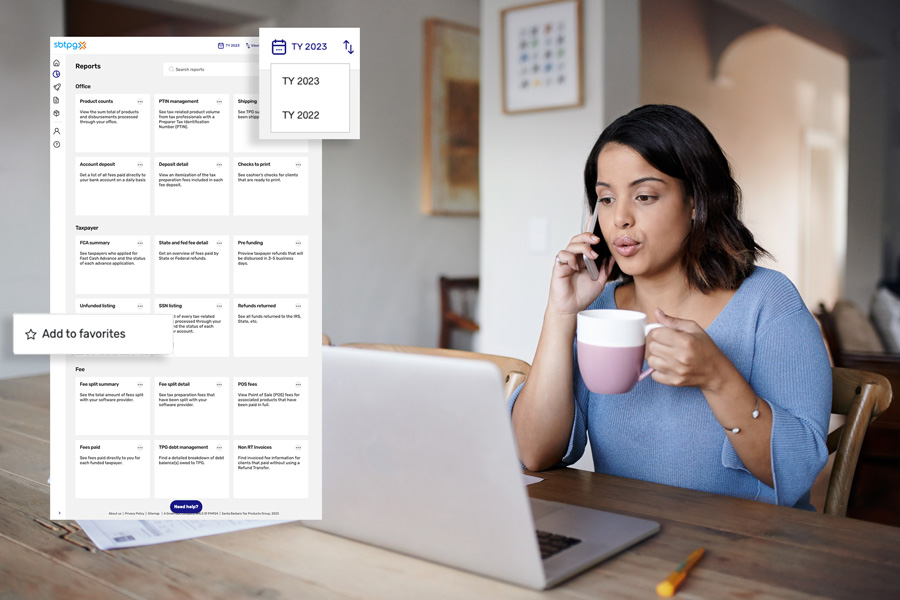

Raising the bar on business reports

It's easy to find what you need in less time with updated reports. With over a dozen pre-built reports viewable from desktop and mobile devices, you can report on dozens of data points. Personalize and filter results down to the data you need.

Marketing & advertising that gets results

Enroll in our Standard Refund Transfer program and we'll set you up with tons of free marketing resources including digital ad designs in English and Spanish, an online listing in our tax pro directory, marketing courses and more.10

Partner with us today

Get the resources you need to succeed

1 Refund Transfers are deposit products using Green Dot Bank, Member FDIC, that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.

2 AutoCollect is an optional service provided by Santa Barbara Tax Products Group, LLC. Fees apply to the ERO only with respect to successful collections. SBTPG is facilitating collections that are being made directly through EROs.

3 Online payments provided by AffiniPay, LLC, which is not an affiliate of Santa Barbara Tax Products Group. Separate fees for this service apply. CPACharge is a registered agent of Wells Fargo Bank, N.A., Concord, CA and Citizens Bank, N.A.

4 Fast Forward by sbtpg is provided by Green Dot Bank. Terms and fees apply. To be eligible for Fast Forward, the taxpayer must have a Refund Transfer for a federal tax refund that is no more than $10,000 and have selected direct deposit. Availability may vary based on the taxpayer's bank participating in Real-Time Payments, IRS pre-notification of pending refund deposit, and availability of funds. $25.00 fee is not charged if the taxpayer is ineligible. If a new Green Dot card is selected in the tax office, the taxpayer will receive the federal refund up to five days early without being charged the $25.00 fee. Check with transmitter for availability.

5 Process 10+ funded Fast Forwards and receive a $5 incentive for each funded Fast Forward deposited to taxpayers' bank accounts by 5/31/25. Incentives paid by 7/15/25.

6 Pre-ACK Fast Cash Advance available Jan. 2. In-season Fast Cash Advance available first day of filing.

7 Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., Member FDIC (it is not the actual tax refund) and is available at participating locations. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Fees for other optional products or product features may apply and will be disclosed at the time of application. Tax returns may be filed electronically without applying for this loan. Loans are offered in amounts from $500-$7,000 and are offered both pre-IRS acknowledgment of the tax return and post-IRS acknowledgment of the tax return. All loans have an Annual Percentage Rate (APR) of 35.99%. For example, for a loan of $2,000 with a repayment period of 30 days, the total amount payable in a single payment is $2,059.16 including principal and interest. Not all consumers will qualify for a loan or for the maximum loan amount. Offer and terms subject to change at any time without prior notice.

8 Green Dot® card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits.

9 $5 incentive or $39.95 incentive paid as long as IRS tax refund is deposited to the Green Dot Prepaid Visa® Card. IRS tax refund deposit must be received by 5/31/25. $5 incentive paid by 6/30/25 for taxpayers with IRS-funded Refund Transfer deposited to a Green Dot Prepaid Visa® Card. $39.95 incentive paid by 6/30/25 for taxpayers with Fast Cash Advance and IRS-funded Refund Transfer deposited to a Green Dot Prepaid Visa® Card. Tax professionals using discount programs do not qualify. If enrolled through a service bureau, please check with bureau associate for details on incentive payment. Must be enrolled in the standard Refund Transfer program to qualify for standard pricing; all discount programs offered through SBTPG are subject to other pricing. A 1099 may be issued for incentive payments exceeding $600. Green Dot cards available while supplies last.

10 Must be enrolled in our Standard Refund Transfer program. Available while supplies last.

11 Tax debt resolution services provided by Community Tax, LLC which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Taxpayer pays a separate fee for this service.

12 Credit & Incentives services provided by Global Government Partners also known as Fifo.com which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Taxpayer pays a separate fee for this service. Paid Sick and Family Leave Credit claims must be filed by April 15, 2025.

13 Separate fees apply for the Marketing Pro service. Santa Barbara Tax Products Group and Green Dot Corporation cannot and do not guarantee your ability to obtain specific results in connection with our products and services.

14 Advance is subject to approval. Must be enrolled in Standard Refund Transfer program to qualify; all discount programs offered through SBTPG are excluded from this program. Software Purchase Assistance advances provided by Green Dot Bank, Member FDIC. Check with transmitter for availability.

15 Must opt-in by January 13 to qualify. Advances subject to approval. Must be enrolled in Standard Refund Transfer program to qualify. All discount programs offered through SBTPG are excluded from this program. Pre Season Funds available only to prior SBTPG clients. Advances provided by Green Dot Bank, Member FDIC. Check with transmitter for availability.

16 Must opt-in by February 16 to qualify. Advances subject to approval. Must be enrolled in standard Refund Transfer program to qualify. All discount programs offered through SBTPG are excluded from this program. Advances provided by Green Dot Bank, Member FDIC. Check with transmitter for availability.

17 Annual fee is $40. Annual Percentage Rate is a fixed 29.88% for purchases. Cash advances accrue interest at 29.88% APR and have a 3% fee. Foreign transactions incur a 3% fee. Balance transfers incur a 5% fee.

Yendo’s products and services are provided by Yendo, Inc., which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Taxpayer pays separate fees associated with this product.

18 Cybersecurity services provided through a partnership with Watch Cloud Cyber Security which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Tax professional pays a separate fee for this service.