Automate your tax preparation fee collection

Collect unfunded tax preparation fees from past-due clients1

We collect past due tax prep fees so you don't have to

Ensure you get paid for the work you've done

Ensure you get paid for the work you've done

We contact clients on your behalf

Fees collected by debit to taxpayer's account or credit card payment

Spend more time preparing returns

And less time worrying about fees

Let us help collect your fees from unfunded Refund Transfer clients

When taxpayers pay-by-refund it's an easy way to get paid. Auto Collect is available for the handful of clients that choose to pay-by-refund but don't receive their tax refund. Save time by having us automatically collect your tax preparation fees from these clients.

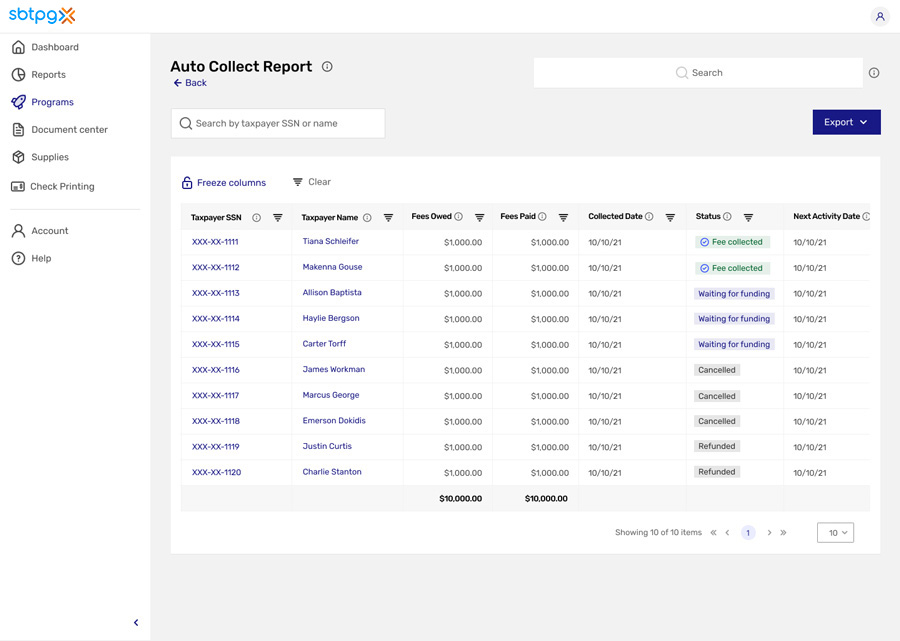

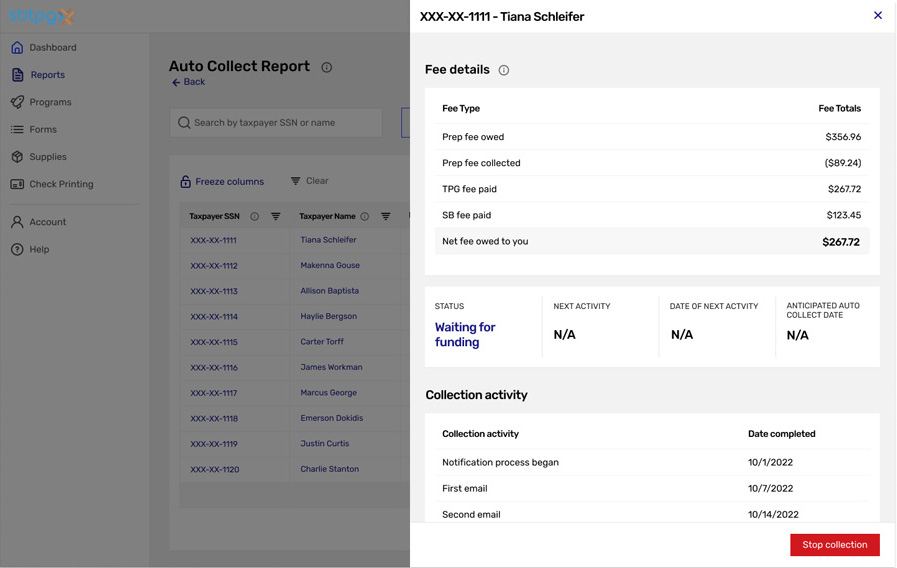

How it works

Let us do the work for you

We contact your unfunded clients*

Once a taxpayer that selected a Refund Transfer with direct deposit is at least 1 month past their expected IRS funding date we will contact your client

Convenient payment options offered

Clients are given the option to conveniently pay your fees with a credit card or bank account

Fees are direct debited

If your client does not respond, we will debit your fees from your client's bank account

Payment issued to you

We collect our processing fee of 25% of the amount debited and the remainder is deposited into your bank account upon completion of the Auto Collect program in mid-October2

* Participating EROs have the option to not collect on certain taxpayers and will have the option to make this determination on a case-by-case basis.

Enroll now to get Auto Collect

1Auto Collect is an optional service provided by Santa Barbara Tax Products Group, LLC (SBTPG). Fees apply to the ERO only with respect to successful collections. SBTPG is facilitating collections that are being made directly through EROs.

2Other than any amounts collected on behalf of software transmitters or other 3rd parties.