NEW! Get early access to your refund1

Get your refund deposited up to 5 days early

No credit? No problem!

You don’t need a good credit score to qualify. Bad credit or no credit is ok.

Works with a network of banks

You don't need to open another bank account to qualify.

Widely available

Fast Forward is available 1st day of tax season thru Oct. 20.

Get money early

Fast Forward is great if you need early access to your federal tax refund.

When you need money fast

The easy choice if you need your refund early

Pay for tax prep with your tax refund using a Refund Transfer2, and request Fast Forward by sbtpg to get your refund direct deposit up to 5 days early.

How it works

See if you qualify

If your tax pro offers Fast Forward, and you are expecting a federal tax refund under $10,000 with a direct deposit you may qualify

Request Fast Forward

Ask your tax professional for pay-by-refund and Fast Forward before your tax return is e-filed

File your tax return

After your return is e-filed you will be notified via email and/or SMS if you qualify*

Refund arrives early

If qualified, you will receive a text or email notification when your refund arrives early*

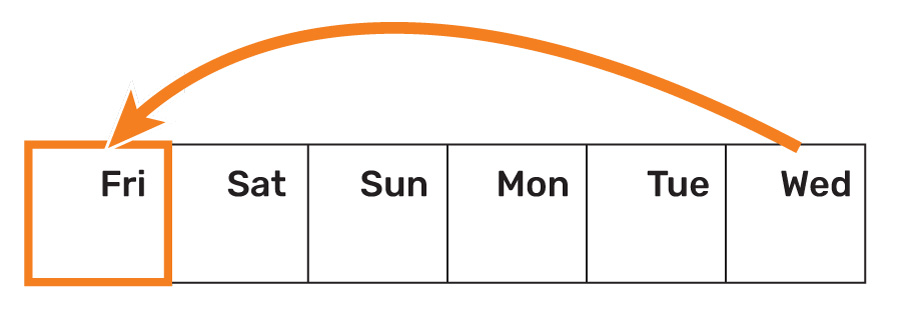

Example

If the IRS notifies us Friday of a federal tax refund effective Wednesday, with Fast Forward the refund is available immediately. With the traditional ACH direct deposit settlement process, the refund would be available on Wednesday.

In this example, the federal tax refund is released 5 days earlier than the IRS effective date.

* Message and data rates may apply.

Get your refund early

Find a tax professional near you

1 Fast Forward by sbtpg is provided by Green Dot Bank. Terms and fees apply. To be eligible for Fast Forward, you must have a Refund Transfer for a federal tax refund that is no more than $10,000 and have selected direct deposit. Availability may vary based on your bank participating in Real-Time Payments, IRS pre-notification of pending refund deposit, and availability of funds. $25.00 fee is not charged if you are ineligible. If a new Green Dot card is selected in the tax office, you will receive the federal refund up to five days early without being charged the $25.00 fee. Please check with your tax professional for availability.

2 Refund Transfers are deposit products using Green Dot Bank, Member FDIC, that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.

© Santa Barbara Tax Products Group, all rights reserved.

PO Box 508 West Chester, OH 45071 | A Green Dot Company NMLS ID 914924 | Online Privacy Statement